Gearhart’s vacation rental plan gets scrutiny

Published 7:55 am Friday, May 27, 2016

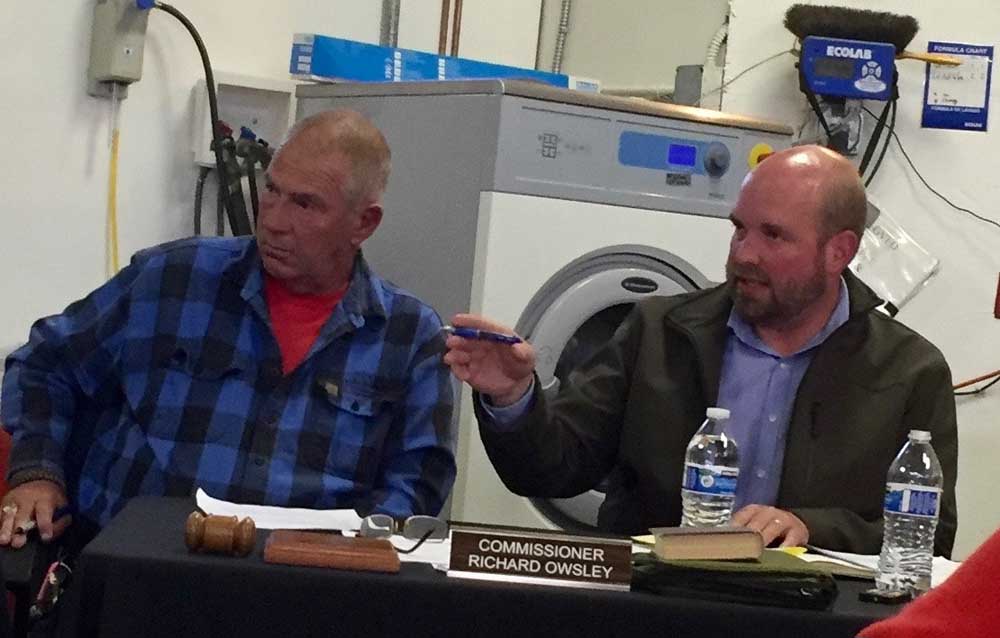

- Planning Commissioner Richard Owsley and City Administrator Chad Sweet at the Planning Commission's May meeting.

Gearhart is ready to enact regulations on vacation rentals, but a key aspect of the proposal may undergo further review.

A plan to require short-term property owners to show proof of filing a 2015 state lodging tax return with the state Department of Revenue is still uncertain.

“We still need to have conversations with them how about how exactly we would be able to partner to make this happen,” Bob Estabrook, public information officer with the Department of Revenue, said Friday.

Gearhart already charges a 7 percent lodging tax and Oregon requires a state lodging tax of 1 percent be paid on a quarterly basis.

After July 1, that tax will increase to 1.8 percent, with the additional funds to pay for state tourism promotion and the Eugene Civic Stadium.

According to the Gearhart Planning Commission proposal, property owners who can show they paid their state lodging tax in 2015 will be eligible to apply for a vacation rental permit, as long as they meet city standards for off-site parking, septic systems and other health and safety codes.

“The thing that makes this tricky is that our lodging tax information about taxpayers is kept at the same level of confidentiality that it is for personal income taxes,” Estabrook said. “So we don’t have a way we can share with the city, ‘These people are compliant, these people are not.’ The system would have to be set up in a way where taxpayers get some kind of certification from us and then they could provide that to the city.”

Short-term rentals require the filing of a quarterly return for the period in which the house is rented as an income property, Estabrook said.

If the property is only rented during certain months, a return would be required for those months only.

“If you’re a hotel and open 365 days a year, you’re filing returns for every single quarter,” Estabrook said. “People with one home or two homes may not always have a reason to file.”

What kind of system Gearhart officials set up is “up to them,” Estabrook said. “We want to have some kind of conversation about what kind of information they’re going to get in what we’re able to certify. There’s not going to be any kind of enforcement mechanism for us because we don’t have a role with local lodging taxes or permitting.

“The Planning Commission has gone through their paces and made a recommendation to the City Council, but it’s just that — a recommendation,” City Administrator Chad Sweet said. “They did a lot of heavy lifting and went through a lot of these regulations, and really honed them down. Now it’s up to the City Council to go along with the regulations, change the recommendations, or to come up with something completely different. That’s their prerogative.”

The regulations “look solid,” Sweet said.

“Common sense regulations, the safety rules, limiting the 30- or 60-day sign-up period, setting the limit at what that comes to, are all probably going to do well,” Sweet said. “The attrition factor will also do well to bring it to the number the community sees fit over time.”

The plan does not allow homeowners to transfer their short-term rental permit after a property is sold.

“I think we’re very preliminary in talking with them,” Estabrook said. “This is a new path they’re trying to blaze in terms of getting a connection between local governments and the state tax. It’ll take some thinking and talking to figure out how we might be able to do that. We don’t have a, ‘We think that’s a good idea or a bad idea’ opinion. It’s something from an administrative perspective we need to work out with them.”

The City Council plans to discuss the proposed short-term rental rules in July.